WARNING: This isn’t financial advice. Investing in illiquid micro-cap companies is risky.

1. Executive Summary

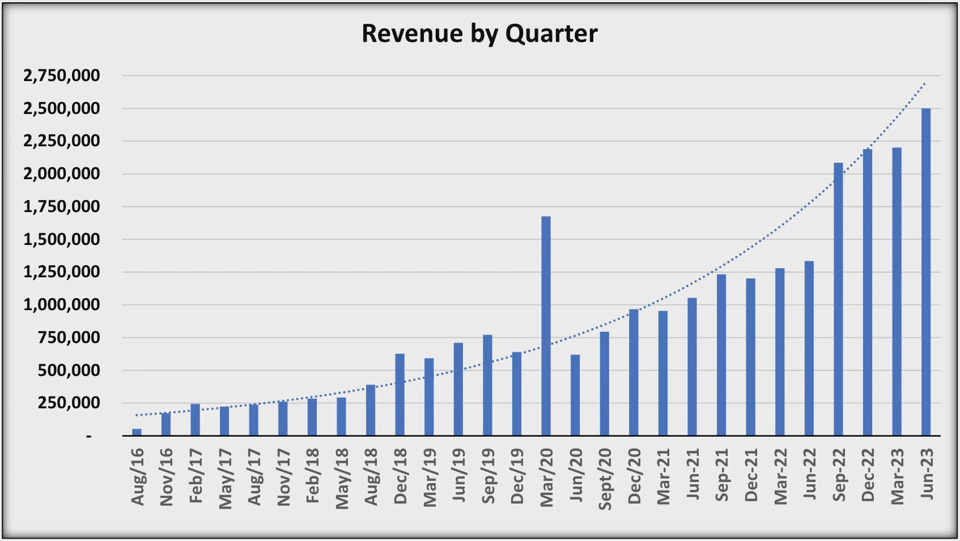

- Undiscovered Canadian SaaS AI company with predictable and sticky revenues growing ~50% YoY.

- “Winner takes all" game with a results-oriented solution that saves clients 10x its price.

- Main player with 7 years head start, ~23% core US market share, and ~2% TAM global share.

- The stock is likely to multi-bag if OSS keeps doing what they’ve been doing.

All amounts in Canadian Dollars. $OSS.V $OSSIF

2. Business description

OneSoft Solutions is a Canadian SaaS company that provides a service for oil & gas pipeline operators called Cognitive Integrity Management (CIM) that takes pipeline sensor data (or ILI data), and numerous other data sets that integrity management engineers consider, to predict pipeline failures.

How it works: Pipelines are classified into ”piggable“ and ”non-piggable”. Piggable pipelines can be regularly inspected with devices called pipeline inspection gauges, or PIGs, that are inserted into launch valves on a pipeline and retrieved at a receiver valve downstream, along with the sensor data they’ve collected. Traditionally this data is then uploaded into Excel files, typically consisting of hundreds or thousands of rows and columns of data. Integrity engineers then manually review the data to predict where failures will occur. Because of the large amount of data involved, engineers typically analyze only about 5% of the most critical data and filter out the rest.

This approach has problems. The U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) publishes statistics on pipeline incidents, which show that pipeline failures continue to be very costly (20-year average of ~$812M per year) and harmful to human safety and the environment.

In addition to costs arising from failure incidents, pipeline operators spend a lot of money conducting maintenance programs, including excavations to inspect for suspected threats to pipeline failures. OneSoft has metrics showing that ~50% of excavations currently being done by operators are unnecessary. Excavation cost varies from tens of thousands to hundreds of thousands, depending on their location. Some of OneSoft’s customers have been able to increase the productivity of their excavations to the 70% range as a result of better predictive analytics of data, thereby reducing their excavation budgets considerably.

CIM uses machine learning, a type of AI, to automate the ingestion, alignment, and analysis of the PIG and other data sets that integrity engineers need to consider for the maintenance of their pipelines. CIM identifies predicted failures with probabilities and economic estimates to help decide where to dig. What used to take weeks or months to do manually and, in many cases, involve external consulting firms can now be automated and done in-house in hours or days, and with more precision. OSS believes that some of their clients are saving at least 10 times what they spend on CIM.

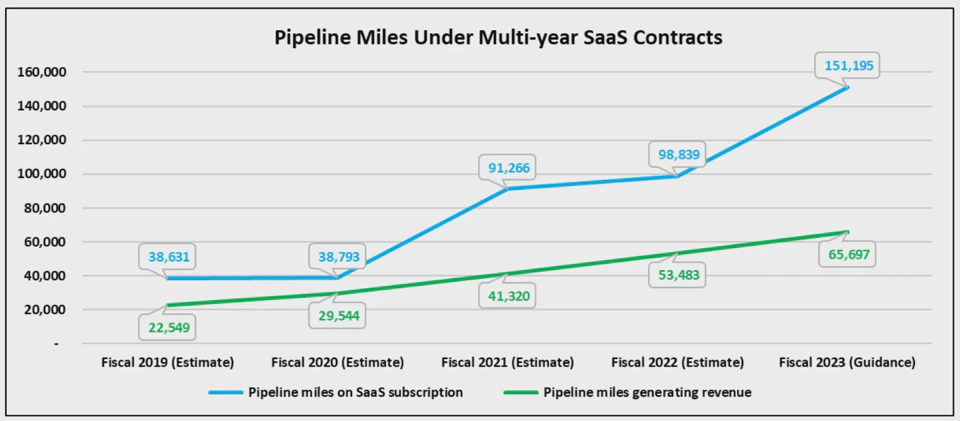

OneSoft’s initial focus with CIM was to support piggable pipelines (660,000 out of 2.7 million US pipeline miles), but work is underway to develop new companion products to address the non-piggable miles, using “direct assessment” techniques.

Clients: OneSoft has 19 pipeline operators using CIM, two of them international. These clients own 23% of the total US piggable pipelines (660k miles), but several also own pipelines outside of the US and plan to use CIM with them. OneSoft’s main market to date has been U.S. operators but they are in talks with prospective clients in South America, the Middle East, and Europe.

Closing a sale usually takes OneSoft 1-3 years because clients are at first skeptical of the cost savings and weary of disruptive changes to their processes. OneSoft is actively working on different ways to accelerate onboarding. When a sale is closed, clients sign agreements to use CIM for 3-10 years that can be renewed.

Competition: 80% of the clients that OneSoft has contacted use the Excel-based solution described earlier, the rest rely on specialized software (e.g. PIMSlider), but those solutions are very limited compared to CIM.

Pricing and revenue dynamics: CIM is a platform: it has core functionality needed by all clients, and a growing set of specialized, optional modules that include probabilistic risk, crack detection, internal corrosion, external corrosion, and geohazard strain management.

Clients pay in advance based on the features and miles data they want to use. When a client starts using CIM they will typically ingest all of their pipeline miles over several years. For example, a client with 10k miles of oil pipes may load and pay for 20k miles in the first year, 40k miles in the second year, etc. Some clients, though, prefer to load all their data at a faster pace, which may cause sudden increases in revenue.

The company has changed pricing models to accommodate new customers’ requirements, with some preferring fixed fees and others preferring to pay for CIM on a Consumption Economics model where specific CIM functionality is invoiced. In 2023, OSS reported revenues that averaged out to $130.97 per mile across all customers.

Regulation: Pipeline operators have two incentives to adopt CIM: it saves them a lot of money and problems, and, they have to because of increasingly stringent regulation by PHMSA, the governmental agency overseeing this industry. OneSoft’s US operations are conducted by its US subsidiary.

Company history: OneSoft started developing CIM in 2016 and launched it in 2017 signing up their first large customer, Phillips 66. A year later they acquired software developed by Phillips 66 as an on-premise software solution and created a cloud version of it. Phillips 66 advanced $3 million of development funding for the project, which OneSoft completed in late 2018. OneSoft owns the IP to this cloud version and pays Phillips 66 a royalty based on revenue from the cloud version, to recover the funding it provided. This arrangement has accelerated OneSoft’s competitive moat, as the functionality that Phillips 66 developed is required by all pipeline operators.

In 2022, OneSoft acquired IP and people (IM Operations) from an engineering firm specialized in pipeline risk management, again accelerating revenue opportunities.

In August 2023, management announced that they were going to increase hiring to accelerate building the features that clients are asking them for, as part of their efforts to continue to increase their competitive moat and future revenues.

Clean balance sheet, nearing profitability: OneSoft currently has $C352k of debt, due to the IM Operations acquisition, but historically debt has been zero. The last capital raise was in 2019, which netted about $8 million after expenses. The Company still had $5 million in cash at Q2 2023 quarter end and appears to be 2-4 quarters away from profitability. The only source of shareholder dilution is stock-based compensation, which is necessary to keep the highly skilled people OneSoft employs. Main expenses are typical of a SaaS company: cloud fees from their only provider, Microsoft, and staff. Gross margins are in line with SaaS businesses, 76% in Q2 2023, and 73.4% in H1 2023.

3. The opportunity

Owner-operator company, shareholder-friendly and competent management: Management and board together own close to 30% of the company and there is no management turnover. Management has made sensible buy-vs-build capital allocation choices like buying the Phillips 66 IP, or buying IM Operations for 1.6x estimated earnings and immediately increasing OneSoft revenues by ~20%. When management sold their previous company, they decided to share most of the gains with shareholders and keep only a minimum to start OSS.

OneSoft has the high ground: New players wanting to enter the market are facing:

- More than 7 years’ worth of effort and tens of millions required to assemble a team and build a solution for a large ARR TAM. Others have tried to build a CIM-like product and failed.

- 1-3 years long sales cycles in an industry that is reluctant to change legacy practices.

- A main player with 7 years of deep industry and technical experience, first-mover advantage, offering a cheap (10x ROI) platform service proven to work, ~20% market share for CIM piggable pipelines, 50%+ YoY growth for the last 7 years, no material debt, ~100% client retention, and a deep sales pipeline that includes non-US operators.

- The longer potential competitors to CIM wait to enter the market, the more data OneSoft’s AI gets, the better CIM becomes, and the more entrenched OneSoft clients become.

- Even though OneSoft is leading from a technology perspective, it continues to operate an ”innovation lab” collaboration hub, open to all pipeline operators, to insure against technical obsolescence and find new revenue opportunities.

- OneSoft continues in hiring mode to accelerate the development of new modules and features that clients are asking for, which essentially guarantees adoption.

OSS has created a “winner takes all” environment and has a robust and expanding competitive moat. This is likely to discourage most potential competitors and larger companies from entering and trying to catch up, and instead incentivize them to acquire OneSoft.

$430M+ TAM: In 2021, OneSoft identified potential TAM at ~$428M ($257M US, $171M ROW). Estimated revenues for 2023 are ~$10M (4% of TAM). OneSoft expects to have ~150k piggable miles under contract by the end of 2023 ($15M in ARR at $100 per mile).

Note, though, that the 2021 TAM estimate is based on minimum revenues of $100/mile, but OneSoft has reported a range of per mile revenue between $107 and $127 per mile since F2019. Final prices for new modules could also change substantially from their 2021 estimates, especially because of OneSoft’s pricing power. Note also that client contracts have built-in inflation and innovation price escalators.

Revenue regularity and stickiness: OneSoft has ~100% client retention, except for 2 companies that were acquired by other operators who have not yet adopted CIM. O&G pipeline operators have been increasing their M&A activity lately and OneSoft expects to see subscribed miles increase in F2023 thanks to 4 such acquisitions so far this year, and whose operations will be onboarded to CIM. The sales cycle is long, but once closed, clients have a strong incentive to stay because their mission-critical integrity management processes will now depend on CIM after it replaces their legacy processes.

Macro tailwinds and incentives: In the US, regulatory forces help CIM gain clients because of increasingly stringent rules that pipeline operators must abide by. Demand for oil & gas in the U.S. is increasing, but building new pipelines is increasingly difficult, which makes existing pipelines more valuable.

Strong relationship with Microsoft: Management has worked with Microsoft for 20 years. They have won multiple Microsoft partner awards, they have been accepted at some of Microsoft’s elite accelerator programs, and continue to receive technical and sales help. OneSoft, in its prior software business, was one of the first companies worldwide to launch a Microsoft Cloud Services service.

AI: OneSoft is an AI company with deep technical expertise and a decades-long relationship with one of the leading AI companies, Microsoft. As the last few years have shown with generative AI, this technology can evolve very quickly and make possible things that previously looked unimaginable.

Buyout: Given OneSoft’s moat and market cap, they’re likely to be bought. When recently asked about this, management said that if offers come their way, they will consider them. Management sold their previous company in 2014 and distributed ~80% of the gains to shareholders via a special dividend, something they mentioned in a recent earnings call.

4. The danger

Long sales cycles could give competitors time to enter the market. A new or existing competitor (e.g. ATP, DNV, Emerson) could acquire an edge and still enter the market and overtake OneSoft. According to OneSoft, it takes so long to close sales because pipeline operators don’t accept OneSoft’s estimate of cost savings until they experience them in their own environment and are also very reluctant to change such mission-critical processes. Presumably, these sales challenges would affect potential competitors who are disadvantaged because OneSoft already has a strongly validated solution that is difficult to displace.

Execution risk: To reach their $430 TAM, OneSoft needs to build new modules, including those that unlock support for non-piggable pipelines and expand internationally, where there seems to be a bit more competition (ATP owns PIMSlider which is reported to monitor 300k pipeline miles).

Regulatory risk: PHMSA could decrease integrity management pressure on companies, perhaps as a consequence of OneSoft’s success in decreasing pipeline failures, and this could change revenue dynamics. Currently, however, PHMSA is stepping up, rather than reducing, regulatory compliance, as evidenced by its latest Mega Rule operational requirements.

Limited TAM growth: Oil and gas U.S. demand is increasing, but it’s also increasingly challenging to build new pipelines because of regulation and environmental concerns. Additionally, there are only about 5-12 years of estimated US oil and gas production reserves which may limit US O&G TAM growth. On the other hand, there’s still enough oil and gas worldwide for about 47-52 years, and these 2021 estimates might be well below the true value.

Microcap: OneSoft is more vulnerable to random events than larger companies, although it’s also likely more nimble to pivot around future challenges.

Single provider: OneSoft currently relies exclusively on Microsoft’s cloud platform to deploy its solutions. If OneSoft’s relationship with Microsoft were to terminate, OneSoft would need to re-tool its technology and solutions to operate on other cloud platforms, like Amazon Web Services. However, given their decades-long relationship and mutually beneficial working relationship, this contingency seems unlikely.

5. Valuation

OneSoft is growing revenues at ~50% YoY and trading at $.81 or 10.4x EV/TTM revenues. The median public SaaS company is growing ~20% and trading at ~7 - 8x. In 2021, with a median growth of ~32%, lower interest rates, and post-COVID cloud computing euphoria, the median multiple was ~18x. We probably won’t get back to 18x any time soon but mean reversion from a 7-year low looks more likely.

This isn’t that bullish. Assuming $10M in 2023, hitting $50M by 2028 implies ~38% YoY growth, and OSS has exceeded that for the last 7 years. The company is also focused on increasing revenue per client, they’re trying to shorten sales cycles, and validation of CIM as the next generation solution for the industry is no longer in question.

In a bullish scenario OSS keeps growing at 50%, interest rates drop, the market acknowledges the strength of OneSoft’s moat and likes that it’s an AI company, and gives it a higher 20x multiple, still below the median 30x SaaS multiple for 33% growth from two years ago. In this scenario, shares could hit $10.10 in 5 years: a 12-bagger at 65% CAGR.

6. Summary

Catalysts

- Continued high revenue growth rates, reaching profitability

- New large customers sign up, especially international ones

- More analyst initiations

- Launch of new CIM modules, especially support for non-piggable pipelines

- Buyout

- Institutional investors start buying, or uplisting to Nasdaq

Risks

- Revenue growth deceleration due to slowing client adoption

- Slow execution extending CIM

- Regulatory risk

- M&A consolidation on partners like Enbridge who don’t want to use OSS

KPIs to follow

- Average price per mile charged

- Miles operated by customers, on SaaS subscription, and generating revenue

Disclosure: As of this writing, I own shares in this company.